We wanted to write this post to address recent discussions we have seen across the community. Whether from Delegates or the wider conversation in Discord, the demand for more verifiable data and greater transparency has been loud and clear. We acknowledge this feedback, and want to assure you that Obol fully embraces these values. It is a priority to fix data inconsistencies across public platforms and ensure the community has a clear view of the Obol’s health.

Here is an update on the steps that have already been taken and what is coming next.

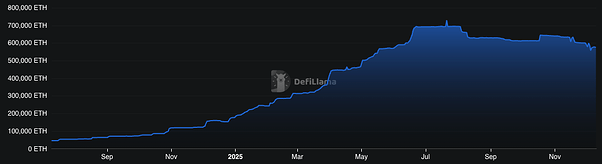

1. Historical TVL Now Live on DefiLlama

One of the first steps we took was to work with the DefiLlama team to publish historical TVL for Obol in a verifiable and standardized way. This is now live.

You can head to DefiLlama and explore the full historical dataset showing the amount of ETH staked on Obol Distributed Validators. If you zoom out, the long-term trend is clearly upward. Several integrations and partnerships that are in the pipeline will surface in the coming weeks and months, further contributing to that trajectory.

2. Next Step: Public Fees & Revenue Metrics

The next major milestone with DefiLlama is to surface protocol fees and revenue publicly.

This is slightly more complex because Obol receives a mix of on-chain and off-chain revenue. Our data team is currently consolidating both sources into a format that is reliable and DefiLlama-compliant. You can expect this data to go live in the coming weeks.

Zooming out: Data quality and public metrics are a major focus for Obol, and you will see continued improvements across all surfaces.

3. On Token Allocations, Exchange Listings & Transparency

For questions regarding token allocations, Obol-owned addresses, or listing fees paid to exchanges, we want to remind the community of Obol’s participation in the Blockworks Token Transparency Report.

We are part of the few projects that proactively worked hard to align with industry standards for transparency. For Obol this is a starting point and we intend to share more over time.

Today, this report is an excellent source of truth and it even publicly details exactly how much was paid to get listed on centralized exchanges. We encourage everyone to review it.

4. Looking Ahead: Token & Governance (January

Beyond data, Obol is preparing for a major strategic phase in the new year. Starting January, you can expect a series of public discussions on the forum regarding:

-

Token Utility & Economics: Thoughts and researched plans for the $OBOL token.

-

Revisiting stOBOL (Staked $OBOL): Moving toward a mechanism that creates value for the ecosystem rather than extracting it.

-

The Future of Governance: What governance means for Obol moving forward.

Obol is currently doing homework on these fronts. It is vital that these plans align with the evolving legal landscape, which moves slower than the tech. This is why Obol has not shared too much too early, but is committed to bringing these topics to a public forum discussion very soon.

5. Early Research: Obol Value Explorer

In the meantime, we are happy to attach a simulator we have been working on to this post.

This tool showcases some of the internal research and explorations Obol has done regarding how the protocol’s growth can lead to a positive flywheel effect for the token. Specifically, it takes a deep dive into Lido’s recent proposals for buybacks and liquidity supply to see how similar models might look for $OBOL. Obol is also conducting research to place $OBOL at the center of the Obol economy.

Please note: This is an exploration to share our thinking transparently, not a finalized proposal or commitment.

Feel free to experiment with the inputs, explore different scenarios, and give feedback.

6. Closing Thoughts

This post is just a first step. A lot of data is already public and verified; more is on the way.

And in January, we will begin a structured series of discussions covering token utility and design, governance evolution, and the future economic architecture of Obol with $OBOL at its center.

We won’t share more than what is responsible or legally allowed but we remain fully committed to transparency and to engaging the community meaningfully throughout this process.

Thanks again to everyone who has been asking questions, pushing for clarity, and contributing constructively.

Who’s ready to start 2026 full speed with Obol?